India’s Bancassurance Boom: A Deep Dive into Strategy, Distribution, and the Next Decade

Introduction: From Side Channel to Strategic Infrastructure

In 2019, insurance distributed through banks in India was seen as a supplementary revenue stream – efficient, scalable, but ultimately transactional. Fast forward to 2024, and bancassurance is no longer an “additional” channel. It has evolved into a key pillar of both banking profitability and insurance accessibility, simultaneously solving for non-interest income pressure, insurance inclusion, and embedded distribution at scale.

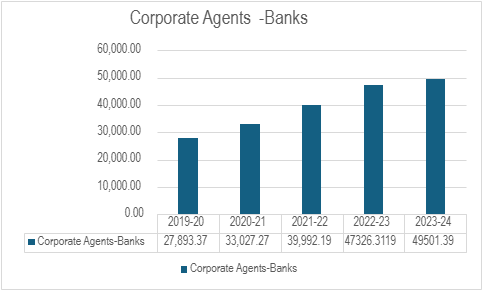

Between FY2019–20 and FY2023–24, premiums sourced through corporate agents – banks surged from ₹27,893 crore ($ 3,359 Million) to ₹49,501 crore ($ 5,964 Million) This 15.3% CAGR, achieved across an inflationary period and pandemic disruption, reflects not just volume but institutional prioritisation.

What’s more, this growth wasn’t uniformly spread – it was led by certain alliances, certain geographies, and a few enabling regulatory moves. Bancassurance, once dismissed as a volume-focused cross-sell engine, has now emerged as India’s dominant platform for contextualised, tech-enabled insurance distribution.

But this transformation has also surfaced new fault lines: suitability vs. scale, digital vs. assisted models, and partnership vs. platform conflicts. To understand where bancassurance is headed next, we unpack the forces that built its current dominance.

Historical Evolution: From Single-Insurer Ties to Multi-Tie Platform

The roots of India’s bancassurance model lie in regulatory liberalisation – specifically the IRDAI’s 2002 Corporate Agency Regulations. These allowed banks to distribute insurance as licensed corporate agents, formalising what was previously an informal referral ecosystem. This structure initially favoured exclusivity and Banks typically partnered with one life insurer and pushed whatever product was on offer, often with limited alignment to customer needs.

The real shift came in 2015 with the introduction of multi-insurer tie-up norms, which permitted banks to work with up to three insurers in each vertical (life, general, health). This opened the door to product diversity and competition, but more importantly, to strategic alignment. Banks began treating insurance as a segment, not a sidekick.

The next major catalyst was digital enablement. Between 2018-2022, banks like ICICI, Axis, and HDFC began integrating insurance journeys within their apps and internet banking flows. Customers were no longer sold insurance – they were nudged into it during salary credits, loan disbursals, or even travel bookings. These nudges were powered by CRM data, but also by a shift in mindset: insurance had become part of customer lifecycle design.

By 2023, with the Ministry of Finance urging PSU banks to prioritise insurance sales at the branch level, the message was clear: bancassurance is now mission-critical to both inclusion and revenue.

Premium Trajectory: Not Just Growth—Structural Dominance

Premium collections over the past five years reveal its development as a key pillar in insurance distribution:

Premium collections over the past five years reveal its development as a key pillar in insurance distribution:

| Channel | FY20 (₹ Cr) | FY24 (₹ Cr) | CAGR (%) |

| Corporate Agents – Banks | 27,893 | 49,501 | 15.3% |

| Direct Selling (including digital) | 7,310 | 14,835 | 19.1% |

| Corporate Agents – Others | 1,564 | 2,956 | 17.2% |

While digital-first models grew rapidly, thanks to insurtechs and aggregators, the bank channel still captured over 33% of all new life insurance policies in FY24 (for the overall Industry. Within Private Sector Insurers, this is higher at >50%). More importantly, it has higher persistency ratios, with 13-month retention above 85% in bank-led channels, compared to 68-72% in agency or D2C models.

What’s driving this quality?

- Lifecycle integration: Insurance is often offered during loans, investments, or milestone events.

- Trust: Banks still enjoy higher brand equity, especially outside metros.

- Data-rich targeting: Banks use transaction history, demographics, and credit behaviour to profile needs.

Premium growth is also not uniform across products. Unit-linked plans (ULIPs) are regaining favour among salaried professionals, while credit-linked group term covers are expanding across retail and MSME loans. Meanwhile, microinsurance products sold through regional rural banks (RRBs) and small finance banks (SFBs) are becoming the frontlines of risk coverage in rural India.

Partnership Deep Dive: Strategic Design, Not Just Distribution

To understand India’s bancassurance boom, we must study the alliances that shaped it

Private Sector Banks:

HDFC Bank + HDFC Life

HDFC Life’s bancassurance business is anchored by HDFC Bank (~63% counter share in FY24, up from ~56%) . HDFC Life has advanced underwriting and sales efficiency through digitised broker and bancassurance tie-ups, underwriting excellence, underpinning its objective to be a tech-savvy, product-rich bancassurance model.

In FY24, HDFC Life had a total bancassurance APE of Rs. 10,435 crores (Individual 7,336 crores + Group 3,099 crores), accounting for over 60% of HDFC Life’s individual new business. Much of this was digitally assisted. HDFC Life persistency rates are among the highest in the industry, often touching 90% at 13 months.

ICICI Bank + ICICI Prudential Life

ICICI Prudential’s bancassurance distribution through ICICI Bank remains a key channel, contributing roughly 29% of its APE. In FY 2024, bancassurance APE reached Rs. 4,598 crores (Individual Life APE: Rs 2,635 crores). ICICI Prudential differentiates itself with digital integration across ICICI’s banking ecosystem, using customer data to offer tailored term, savings, and investment-linked plans—boosted by seamless in-branch and online sales execution. Its iMobile Pay app offers real-time insurance prompts based on user activity. This behavioural selling model is scalable and intelligent, and the insurer has reported double-digit YoY growth in pure digital sales.

Axis Bank + Axis Max Life

Axis Bank and Max Life have been Bancassurance partners for many years, with Axis Bank acquiring a 19% equity in Max Life in recent years, following a successful longstanding partnership. Axis Max Life provides the partnership with hybrid products—ULIPs with health or CI riders, flexible premium frequency, and bundled wellness add-ons. This co-creation mindset has resulted in bancassurance accounting for over 55% of Max Life’s total retail premium of Rs. 4,986 crores. Axis Max Life had a total bancassurance APE of Rs. 5,869 crores (Individual 4,986 crores + Group Rs. 883 crores).

Public Sector Banks:

SBI + SBI Life:

With the widest footprint—22,500+ branches and 45 crore account holders—SBI’s bancassurance engine is built for scale. In FY24, SBI Life bancassurance APE was Rs. 19,512 crores (Individual Rs 15,288 crores + Group Rs. 4,224 crores) illustrating its huge success. SBI has also focussed on the microinsurance formats tailored for informal workers, farmers, and pensioners. Its success lies not just in size but in its product modularity and portfolio.

Stakeholder Opportunity Matrix: Banks, Insurers, and Segments

The current phase of India’s bancassurance boom is creating differentiated opportunity pools—across stakeholders and customer segments.

For Banks: A Shift from Cross-Sell to Monetisation Stack

Leading private sector banks now derive 20-25% of total distribution income from insurance commissions. But this isn’t simply about fee income—it’s about owning more of the customer’s financial wallet. When banks bundle insurance into premium accounts, home loans, or wealth offerings, they increase customer lifetime value (CLV), reduce attrition, and gain richer behavioural data.

Moreover, by linking commissions to persistency and claims experience—as IRDAI is now encouraging—banks can start treating insurance as a core balance sheet hedging tool, not just a retail sales target.

For Insurers: Intelligent Access and Better Risk Pools

Bancassurance helps insurers overcome their two biggest pain points: high customer acquisition costs and poor underwriting clarity.

The CAC reduction via banks is significant – up to 50% lower than agent or aggregator models. More importantly, access to bank data (when consented) allows superior segmentation, better claim forecasting, and precision pricing. As BCG notes in its 2024 report, “Bancassurance channels can reduce acquisition costs by 40-50% compared to traditional distribution, while enhancing access to high-quality customer data.”

Customer Opportunity Zones

- Urban salaried class: Most responsive to ULIPs, bundled investment plans, tax-linked insurance, and employer-group plans.

- Mass affluent / HNIs: Willing to pay for personalised term with riders, annuity-linked retirement bundles, and wealth insurance.

- MSMEs and salaried workers: Opportunity lies in credit-linked protection (term + critical illness + income loss) bundled with working capital or personal loans.

- Rural/low-income: Low-premium microinsurance formats with flexible payment, assisted digital issuance, and bundled benefits (health + life + personal accident).

Each of these segments requires a different product stack, onboarding design, and claims narrative—and bancassurance is now mature enough to enable that diversity.

Structural Tensions: What’s Holding Back the Model

While bancassurance has become India’s most potent insurance distribution model, its growing maturity has also exposed operational, ethical, and regulatory tensions that must be acknowledged—and solved—for long-term resilience.

Misalignment Between Bank Incentives and Policy Quality

For decades, bancassurance incentives have been structured around volume-linked commissions. This model often prioritised short-term conversions over long-term policy performance. The result? High lapse ratios in Tier-2 and Tier-3 markets, mis-selling complaints, and inadequate claims servicing expectations.

As of FY24, 15% of all complaints registered with IRDAI were linked to mis-selling via corporate agents, often involving cases where customers were unaware of lock-ins, benefit exclusions, or premium terms. Public sector banks, especially, are still grappling with quota-driven pressure cascaded down to branch managers—with insurance sales treated as just another numeric target.

Channel Conflict Between Insurers’ D2C and Bancassurance Units

Insurers investing in digital D2C channels often compete with their own bancassurance arms. For example, a digitally-aware customer receiving an SMS from the insurer’s website might also be getting prompted by their bank RM to buy the same policy—with different pricing, onboarding flow, or coverage terms.

This creates friction between channel heads, cannibalisation risk, and confusion for the customer. Most insurers still lack a unified architecture for managing these overlaps, leading to internal misalignment on marketing spends, attribution, and renewal ownership.

Regulatory Ambiguity Around Data Sharing and Suitability

With the passage of India’s Digital Personal Data Protection Act (DPDPA) in 2023, the traditional flow of customer data from banks to insurers (for underwriting or targeting) now requires explicit, purpose-bound, and revocable consent.

Many bank-insurer partnerships still operate in grey zones where data access protocols are vague, and customers are unaware of where their information flows. Without clear, standardised data governance frameworks, the same technology that powers hyper-personalised selling can become a compliance risk.

Similarly, IRDAI’s guidelines on suitability have evolved, but their enforcement varies widely across banks. Few institutions maintain real-time logs of how a sold policy matches a customer’s financial goals, liabilities, or health conditions.

The 2030 Outlook: Platformisation, Intelligence, and Embedded Risk Architecture

If the last decade was about formalizing and scaling bancassurance, the next one will be about platforming and personalising it. Four key shifts are already underway.

- Bancassurance as Platform, Not Channel

By 2030, top banks will stop treating insurance as a vertical and start integrating it into product design, credit risk architecture, and financial wellness ecosystems. For example, a business loan will not just be priced by credit score—but also adjusted for whether the customer takes embedded protection against death, hospitalization, or business interruption.

These offers won’t feel like policies—they’ll feel like risk-adjusted pricing bundles. Banks that build this into their core risk stack will gain competitive edge on both margins and trust.

- Open Architecture at Scale

Today, only a few private sector banks offer multi-insurer choices to customers. But IRDAI is nudging the sector toward full open architecture, where customers can choose across life, health, and general insurance from multiple insurers—just like UPI allows open payment flows.

This will increase competition, improve product design, and force banks to move beyond loyalty-based exclusivity toward intelligent orchestration.

- AI-Driven Underwriting and Suitability Engines

Banks are increasingly deploying AI models to dynamically match customers with products—based on affordability, life-stage, family risk profile, and policy complexity. These models will move beyond selling to include automated suitability documentation, early warning on lapse risk, and even claims prediction for actuarial alignment.

This will not only improve performance—it will also reduce mis-selling, enhance persistency, and protect banks from regulatory censure.

- Bancassurance + Embedded + Ecosystem Convergence

By the end of this decade, bancassurance will overlap with embedded insurance models—where telecom players, payment banks, NBFCs, and ecommerce platforms all plug into the same product infrastructure.

Banks will increasingly function not just as distributors, but as risk orchestration platforms—curating, bundling, underwriting, and servicing protection alongside finance. In this future, the insurer may be invisible—but the bank remains the anchor of the customer experience.

Strategic Recommendations: The Magi View

For bancassurance to sustain its momentum and credibility in India’s next phase of growth, stakeholders must invest in depth—not just distribution.

-

For Banks

- Elevate bancassurance to a strategic business line with its own KPIs, analytics, and product innovation.

- Embed insurance into digital journeys including mobile apps, net banking, and assisted voice channels for account opening, lending, renewal, and lifestyle events.

- Move from volume to value metrics: Track persistency, suitability match rate, claims satisfaction—not just policy count.

- Strengthen internal sales governance frameworks to prevent mis-selling, especially in PSU networks.

- Invest in training, compliance systems, and customer support protocols.

- Use transaction data to enable lifecycle-based insurance triggers (e.g., child education milestones, new credit cards, EMI status).

For Insurers

- Design bank-specific, flexible and modular products with simplified features, renewable covers, and hyper-personalised pricing models that can be issued instantly.

- Create co-branded digital platforms and dashboards for policyholders.

- Offer field support teams and digital tools for branch and frontline training.

- Invest in real-time integration with bank APIs, offering instant underwriting and policy issuance.

- Set up support units and grievance redress teams dedicated to bank partners.

For Regulators and Policymakers

- Reinforce customer suitability norms and sales conduct standards.

- Reward banks and insurers that improve policy persistency, not just distribution numbers.

- Incentivise inclusive product development for underserved groups.

- Ensure data governance and customer protection through evolving norms under Bima Sugam.

For more on Strategic Recommendations, read our earlier article in this series “India’s Bancassurance Boom: Mapping Growth and Market Potential“

Conclusion: Bancassurance as India’s Financial Trust Layer

Layer

Bancassurance in India is no longer a vertical—it is a horizontal trust layer embedded across retail finance. It protects borrowers, de-risks banks, funds claims, and reduces out-of-pocket shocks—while offering insurers access, stability, and insight.

The future will belong to institutions that see beyond selling and start building:

Building customer trust.

Building long-term risk infrastructure.

Building intelligence-led personalisation.

Building for India’s financial resilience.

Banks and insurers who treat this model as infrastructure, not quota, will not only grow—but lead India’s journey toward “Insurance for All” by 2047.