India’s Q1 GDP – Services Lead, Manufacturing Follows

India’s GDP data for the first quarter of FY25 gives a clear picture of how the economy is shaping up in the post-pandemic period. The overall growth rate of 6.5% was in line with what many expected. But the real story lies beneath this headline number — in the details of how different sectors are performing.

Early signs show that some parts of the economy are moving ahead faster than others. The services sector continues to expand strongly. At the same time, manufacturing, which many hoped would pick up sharply, is still seeing a slower recovery. These trends are important to watch, as they could influence key areas such as job creation, trade strength, and long-term economic balance and is a key area of focus for financial institutions, investors, and policymakers alike.

Growth Pattern Across the Year

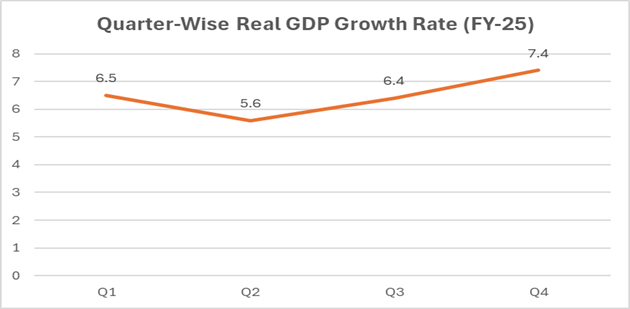

Quarter-wise data shows some variation in momentum:

- Q1 FY25: 6.5%

- Q2 FY25: 5.6%

- Q3 FY25: 6.4%

- Q4 FY25: 7.4%

This suggests that the economy started the year with steady growth, faced a mild dip in Q2, and regained strength toward the end of the year.

India’s Q1 FY25 GDP: Key Growth Contributors by Sector

As per the latest estimates from the Ministry of Statistics and Programme Implementation (MoSPI), India’s economy is expected to grow by 6.5% in FY25, with the total GDP projected at ₹187.97 lakh crore (at constant 2011–12 prices). This is slightly slower than last year’s revised growth of 9.2%, but it reflects a return to more stable growth after two years of unusual ups and downs.

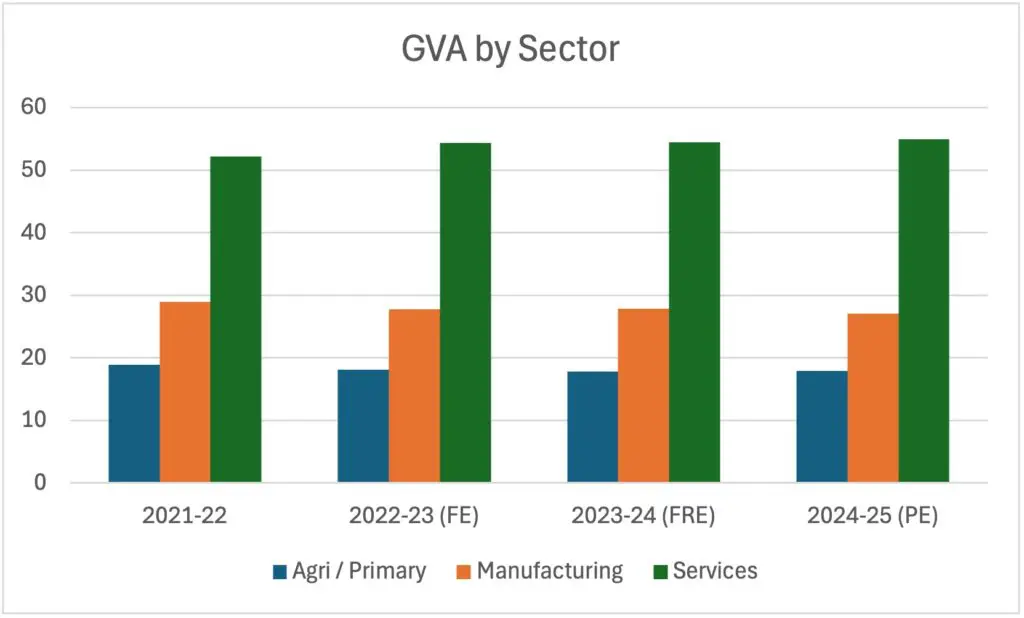

In the first quarter (Q1) of FY25, the economy grew by 6.5%, showing continued strength overall. But when we look closer at the numbers for each sector, a mixed picture begins to emerge. The data on Gross Value Added (GVA) which measures the value of goods and services produced in the economy excluding taxes and subsidies shows that not all parts of the economy are growing at the same pace — and that’s where things get interesting.

- Service Sector grew by 5%, raising its share in GVA to 54.9% — the highest in recent years.

- Industrial (secondary) sector growth remained subdued at 3%, with its share falling to 27.1% of GVA.

- Agriculture Sector which includes agriculture and allied activities, expanded by 6%, showing resilience despite early monsoon uncertainty.

Services Sector: The Unambiguous Growth Engine

The continued dominance of the services sector reflects structural shifts in the economy. Key segments such as financial services, trade, transport, real estate, communications, and public administration have gained momentum. These are also the areas benefiting from sustained urban demand, digital transformation, and increased government and private sector spending on infrastructure and technology.

Notably, private consumption grew by 7.2%, underpinned largely by services-related demand. In parallel, gross fixed capital formation (GFCF) — which indicates the level of investment in fixed assets such as buildings, machinery, and equipment grew at 7.1%, with Q4 FY25 showing a healthy uptick to 9.4%.

Manufacturing and Construction: A Slower Climb

In contrast, the manufacturing sub-sector continues to face challenges. Export-linked industries have felt the impact of muted global trade, and MSMEs continue to grapple with credit access, input costs, and tepid domestic demand. The overall secondary sector’s reduced contribution to GVA signals the need for policy support — particularly in accelerating the PLI (Production Linked Incentive) schemes, industrial park development, and logistics infrastructure.

Construction activity showed moderate growth, supported by public infrastructure spending, but high input prices and regional labour shortages remain impediments to a broader turnaround.

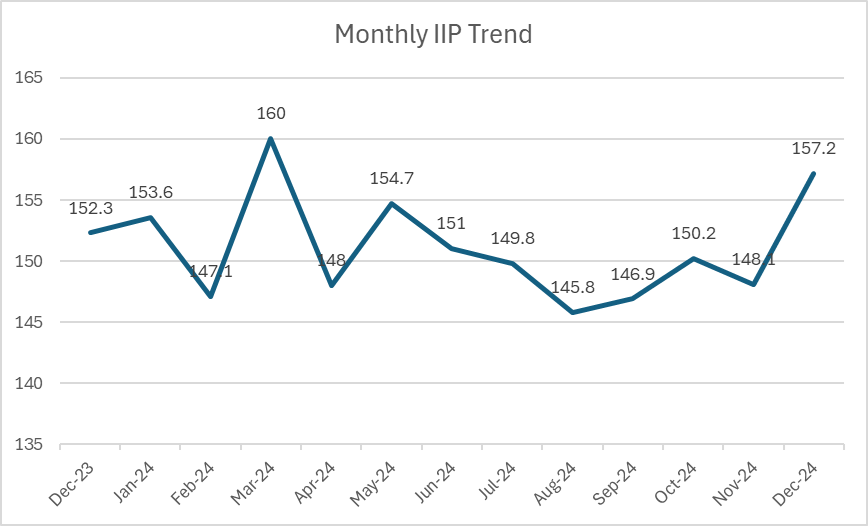

Industrial Trends: Mixed Recovery

India’s Index of Industrial Production (IIP) – a monthly indicator that tracks the volume of production across manufacturing, mining, and electricity sectors highlights a varied picture:

- Manufacturing grew at 4% in FY25 (down from 5.7% last year).

- Electricity output rose by 4%.

- Mining slowed to 3% from 8.5%.

- Miscellaneous Services growth was 4%.

Although there are signs of recovery, especially in electricity and manufacturing, the pace remains uneven, indicating that industrial revival is still a work in progress.

Agriculture and Rural Economy: Stable but Weather-Sensitive

Agricultural GVA rose by 4.6%, a relatively stable performance. However, elevated food inflation at 6.7% — driven by unseasonal rains, heatwaves, and tight supply conditions — points to ongoing climate vulnerability in rural India. With the monsoon season underway, the impact on kharif sowing, rural wages, and food prices will be critical to monitor in the coming months.

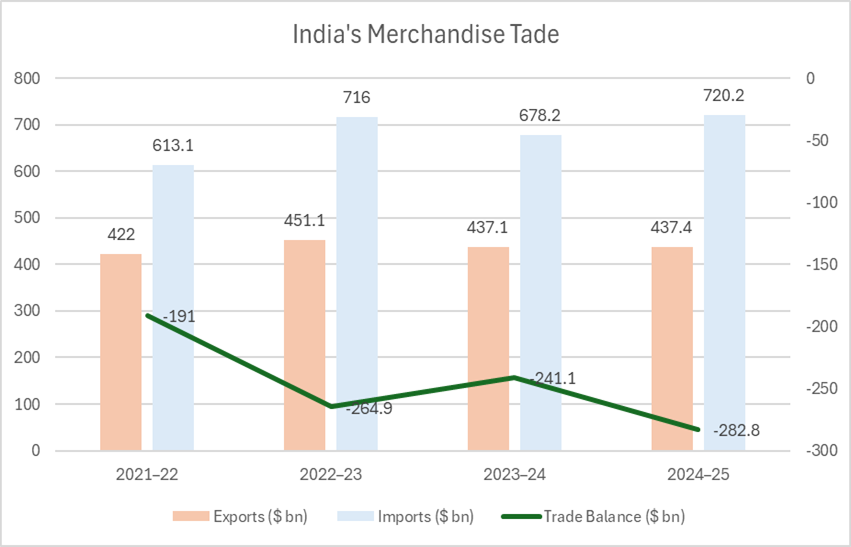

External Sector: Trade Deficit Increases as Imports Pick Up

India’s external sector paints a mixed picture. While merchandise exports remained flat at $437.4 billion, imports climbed to $720.2 billion, resulting in a trade deficit of $282.8 billion. This is a significant increase over the previous year, and reflects resilient demand for capital goods, energy, and electronics, even as export recovery remains weak.

However, FDI trends offer a counterweight. In the first half of FY25, FDI inflows touched $42.1 billion, marking a 26% year-on-year increase. Cumulatively, India has crossed the $1 trillion mark in total FDI since 2000, with a strong pipeline of greenfield projects and infrastructure deals. These trends highlight continued international investor confidence, especially in services, digital, clean energy, and logistics sectors.

Inflation and Trade: Signs of Stabilization

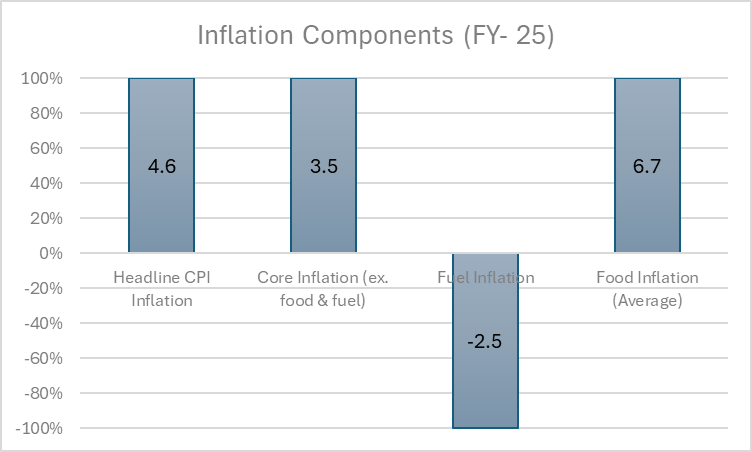

Inflation has shown signs of cooling:

- Headline CPI inflation which measures the change in retail prices of a basket of goods and services eased to 6%, moving closer to the RBI’s 4% target.

- Fuel inflation turned negative (-2.5%) due to lower global oil prices.

- Food inflation remained relatively high at 7%, driven by supply constraints.

On the trade front:

- Exports remained flat at $437.4 billion.

- Imports rose to $720.2 billion, widening the trade deficit to $282.8 billion.

- Export growth was nearly flat (1%), while imports grew by 6.2%, led by recovery in domestic demand.

Headline CPI inflation eased to 4.6%, coming closer to the RBI’s 4% target, and core inflation dropped to 3.5%. This moderation has been aided by a 2.5% deflation in fuel prices, due to softer global energy prices and government price interventions in LPG and kerosene. However, food inflation remains elevated and uneven, especially in pulses, cereals, and perishables.

The Reserve Bank of India has held rates steady, balancing inflation management with growth support. The central bank is expected to remain watchful, especially in light of potential US Fed actions, global crude price volatility, and monetary-fiscal coordination requirements.

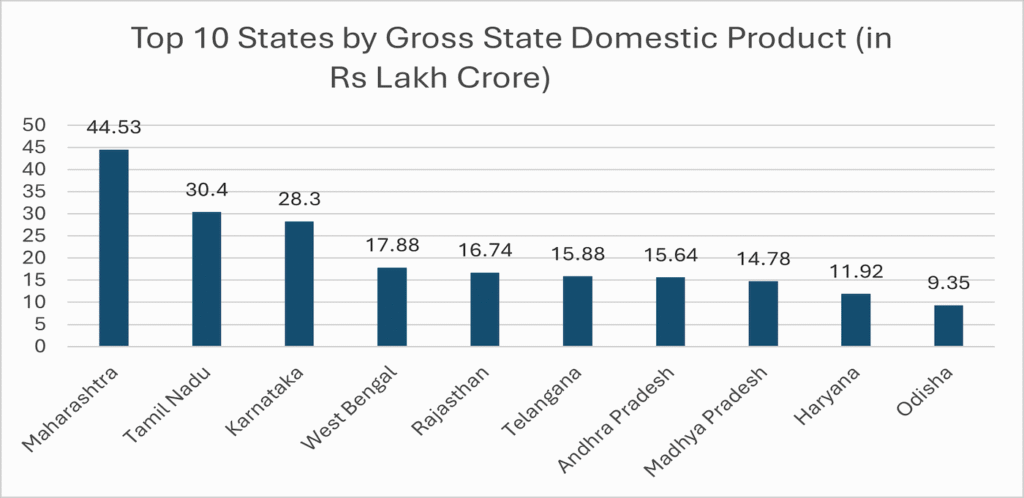

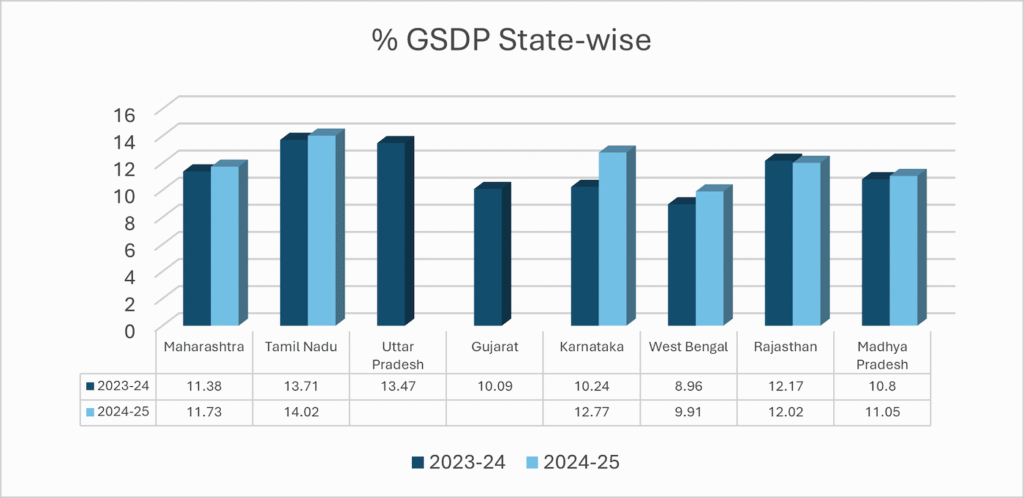

State- Level Economic Activity

Recent GSDP data for FY25 highlights growing regional divergence. States like Tamil Nadu (14.02%), Karnataka (12.77%), and Maharashtra (11.73%) have outpaced the national average, driven by strong manufacturing clusters, digital economy hubs, and infrastructure projects.

In contrast, eastern and some northern states continue to report lower growth, reflecting structural disparities in investment, skills, and connectivity. With India increasingly becoming a multi-polar growth economy, state-level reforms and fiscal prudence will play an outsized role in sustaining national momentum.

Risks on the Horizon

While the data underscores economic stability, the path ahead is not without risks:

- Global crude oil price volatility could reverse disinflation trends and pressure the current account.

- El Niño-linked monsoon irregularities may disrupt rural output and push food inflation higher.

- Lag in export recovery despite improved global trade momentum is a concern.

- Slower-than-expected industrial growth could weigh on employment and capacity utilization.

- Geopolitical uncertainty and capital flow volatility remain external pressure points.

Conclusion

India enters the rest of FY25 with a sound macro base, anchored by stable inflation, moderate growth, and steady consumption. However, for a more inclusive and sustainable expansion, attention must shift to revitalizing the industrial base, enhancing export competitiveness, and addressing rural vulnerabilities.

As consultants, our interpretation is one of measured optimism: the Indian economy is stable, but not immune. Macro management will require sharp sectoral focus, state-level activation, and coordinated policy support. The next two quarters will be crucial to determine whether manufacturing, exports, and investment can match the momentum of services.

About This Series:

“Economics Insights” by MAGI Research & Consultants Pvt. Ltd. delivers monthly macroeconomic perspectives, sectoral trends, and event-based commentary for leaders in banking, policy, trade, and investment.